jefferson parish property tax sale

As per LA RS 472153 all unsettled property taxes are read aloud to the. The tax will add 11771 to the annual bill for a homestead-exempt property valued at 224000 the average.

November Election Results For Jefferson Parish Wwltv Com

The sale of Louisiana Tax Deeds Hybrid are final and winning bidders are conveyed either a Tax Deed or a Sheriffs Deed.

. Ad Find Out the Market Value of Any Property and Past Sale Prices. Detailed listings of foreclosures short sales auction homes land bank properties. Revenue Information Bulletin 18-017.

Click Here to view the latest Judicial Advertisement as published in The New Orleans Advocate. The Jefferson Parish sales tax rate is. Municipal address of the property for which a payoff quote is requested.

To 430 pm Monday through Friday. On the scheduled date. The New Orleans Advocate contains the Judicial Advertisements and legal notices that the Sheriff of Jefferson Parish is required to publish under LA.

Name address telephone number fax number email of person or entity requesting the information. Does anyone really fail to pay his or her taxes. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible.

Generally the minimum bid at an Jefferson Parish Tax Deeds Hybrid sale is the amount of back taxes owed as well as any and all costs associated with selling the property. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Jefferson Parish Assessors Office.

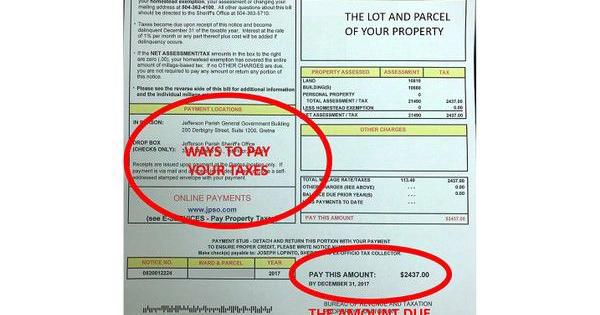

Property tax bills may be remitted via mail hand-delivery or paid online at our website. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The Louisiana state sales tax rate is currently.

How much are property taxes in Jefferson Parish. Sunday March 6 2022. Search only database of 8 mil and more summaries.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Millages Wards. In Building D of the Westbank Administration Complex at.

Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 Gretna and is open to the public from 830 am. Groceries are exempt from the Jefferson Parish and Louisiana state. Ad Buy Tax Delinquent Homes and Save Up to 50.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that. Welcome to the Jefferson Parish Judicial Sales.

Requests for payoffs on liens orders and judgments in favor of the Parish of Jefferson may be obtained by providing the following. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Collected from the entire web and summarized to include only the most important parts of it.

See detailed property tax report for 1200 cleary ave jefferson parish la. The JPSO is tasked with the responsibility of seizing property that is in default and holding judicial auctions and sales on behalf of the creditor. 2016 Jefferson Parish Assessors Office.

043 of home value. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Jefferson Parish Property Tax.

Register for 1 to See All Listings Online. Yes - Nearly 100 real estate property accounts are sold each year for delinquent taxes. This auction includes 57 properties located throughout Jefferson Parish including properties in Metairie Jefferson.

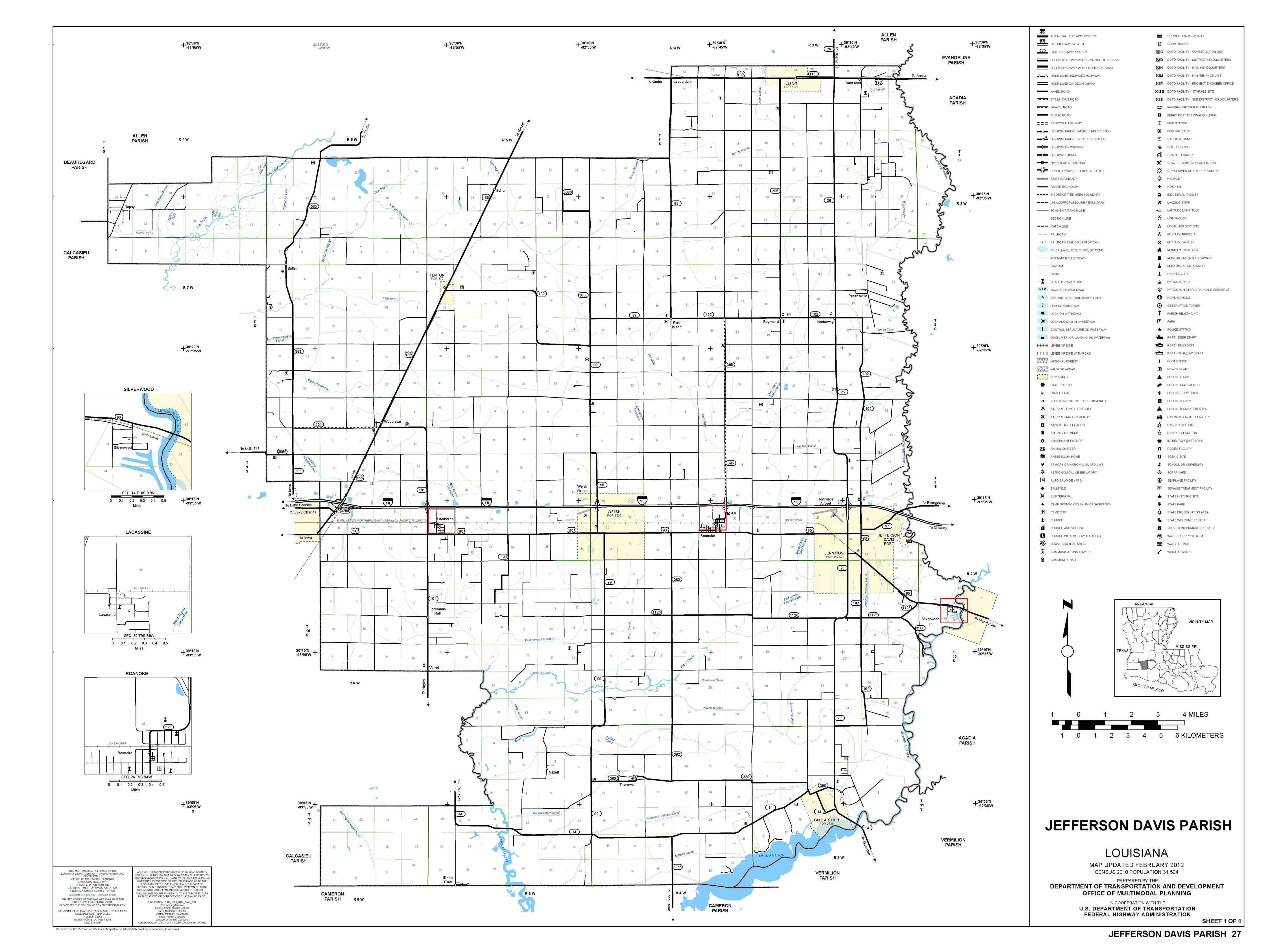

A separate tax return is used to report these sales. The Tax Sale is held at the Jefferson Davis Parish Courthouse located at 300 N. Jefferson parish louisiana property tax rates.

Jefferson parish property tax sale. Adjudicated Property Auction to be Held Online on August 15 August 19 2020. 5 hours ago Jefferson Parish Property Tax Sale.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. You must submit your change of address in writing to the address below. Yearly median tax in Jefferson Parish.

Jefferson Parish Sales Tax Rate. The Judicial Sales Office hours are 800 am to 430 pm Monday through Friday. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The 2018 United States Supreme Court decision in South Dakota v. The Jefferson Parish sales tax rate is. Welcome to the Jefferson Parish Assessors office.

The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax. Louisiana is ranked 1929th of the 3143 counties in the United States in order of. Jefferson Parish Property Tax Sale.

Advanced searches left. The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish. However according to state law Tax Deeds Hybrid purchased at an Jefferson.

Can you tell me a little about the Tax Sale. This is the total of state and parish sales tax. This is the total of state and parish sales tax rates.

Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana. Its duties also include organizing and directing annual tax sales. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

11771 5 hours ago Just Now Jefferson pay is currently the lowest of the bunch and school administrators say Jefferson has lost 1500 teachers in the past three years. Sale date address writ amount appraisal 805-993 deutsche bank national trust company as trustee for ameriquest mortgage securities inc asset-backed pass-through certificates series 2004-r12 vs the opened succession of rita bianchini additon aka rita bianchini rita additon and merry additon teal aka merry additon merry teal merry. The sales are held each Wednesday at 10 am.

Can be used as content for research and analysis. The trial court as well as the court of appeals previously ruled the property owner did not have to pay anything to annul the tax sale since it occurred prior to his purchase. State St in Jennings at 10 am.

Home Blog Pro Plans Scholar Login.

Jefferson Parish Sales Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

November Election Results For Jefferson Parish Wwltv Com

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Tax Division Jefferson Davis Parish Sheriff S Office

Jefferson Parish Property Tax Sale

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Tax Division Jefferson Davis Parish Sheriff S Office